As Europe moves towards its ambitious goal of carbon neutrality, the trucking industry finds itself at a crossroads. Heavy-duty vehicles (HDVs) are among the largest sources of CO2 emissions in Europe, contributing significantly to the transport sector's carbon footprint. Therefore, comparing the total cost of owning a traditional truck with that of its electric version has become crucial to understanding long-term economic viability.

This article examines the cost comparison between electric and traditional trucks in the European market, drawing insights from recent studies by the International Council on Clean Transportation (ICCT) and the ECG Association.

The Emissions Challenge

Heavy-duty vehicles are responsible for a disproportionate share of road transport CO2 emissions in the EU and UK, accounting for 27% of the total. This stark figure underscores the urgency of transitioning to cleaner alternatives. The European Commission, recognizing this need, has already implemented CO2 emissions standards for HDVs and is set to release updated standards in the near future, building upon the existing EU 2019/1242 regulation.

Decarbonization Pathways

Several alternative decarbonization pathways are being explored to replace the widely deployed diesel truck technology in Europe. An ICCT study examines seven key pathways:

- Battery Electric Trucks: Powered by the European electricity grid, these vehicles charge at private depots and public fast-charging stations.

- Hydrogen Fuel-Cell Trucks: These utilize green hydrogen produced through renewable electrolysis.

- Conventional Trucks with HVO: Using hydrotreated vegetable oil produced from waste oils in the EU.

- Conventional Trucks with Synthetic Diesel: E-diesel produced in Brazil and imported into the EU.

- Conventional Trucks with Bio-CNG: Bio-compressed natural gas produced in the EU from waste and residue materials.

- Hydrogen Internal Combustion Engine Trucks: Conventional trucks fueled by green hydrogen.

- Hydrogen-Diesel Dual-Fuel Trucks:Operating with at least 90% hydrogen and no more than 10% diesel fuel.

Total Cost of Ownership Analysis

To compare these various options, the ICCT study employs a Total Cost of Ownership (TCO) analysis. This comprehensive approach considers several factors:

- Truck acquisition costs

- European-average fuel prices

- Maintenance expenses

- European-average road tolls, taxes, and levies

The TCO analysis covers various HDV segments, including long-haul tractor-trailers, regional and urban delivery rigid trucks, and light-duty urban delivery trucks. This broad scope ensures a comprehensive view of the different HDV applications in Europe, focusing on segments with the highest sales shares.

Key findings from the TCO analysis reveal some promising trends for electric trucks:

- Battery Electric Trucks: Projected to be the least-cost decarbonization pathway for most truck classes before 2030. Medium- and light-duty urban battery-electric trucks have already achieved TCO parity with their diesel counterparts, primarily due to lower operational expenses offsetting higher upfront costs.

- Heavy-Duty Long-Haul Trucks: Expected to reach TCO parity with diesel between 2025 and 2026. The later parity date is due to the more expensive upfront costs driven by the large batteries needed for high daily driving ranges.

- Hydrogen Fuel-Cell Trucks: Anticipated to become cost-competitive with diesel trucks by 2035. The expected reduction in green hydrogen fuel prices in the 2030-2040 timeframe will play a crucial role in this shift.

- Alternative Fuel Trucks: Conventional trucks powered by alternative low-GHG fuels such as HVO, e-diesel, and bio-CNG are projected to struggle economically. By 2030, they are expected to have a 15% to 45% higher TCO than their zero-emission counterparts.

Economic Competitiveness of Electric Trucks

While the long-term outlook for electric trucks is promising, current market conditions present some challenges. According to the ECG Association, the current prices of electric trucks can be up to three times as much as diesel trucks. However, this price differential is being actively addressed through various means which can actually make electric vehicles cheaper in the long run:

- Lower Operational Expenses: Despite higher upfront costs, electric trucks benefit from lower fuel and maintenance costs over their lifetime.

- Varied Competitiveness: The economic viability of electric trucks varies by class and application. Urban delivery trucks, for instance, are already cost-competitive in many scenarios.

- Long-Term Projections: In the long term, fuel-cell trucks are expected to record a 10% to 20% higher TCO than battery electric trucks, while both are projected to outperform diesel and alternative fuel options.

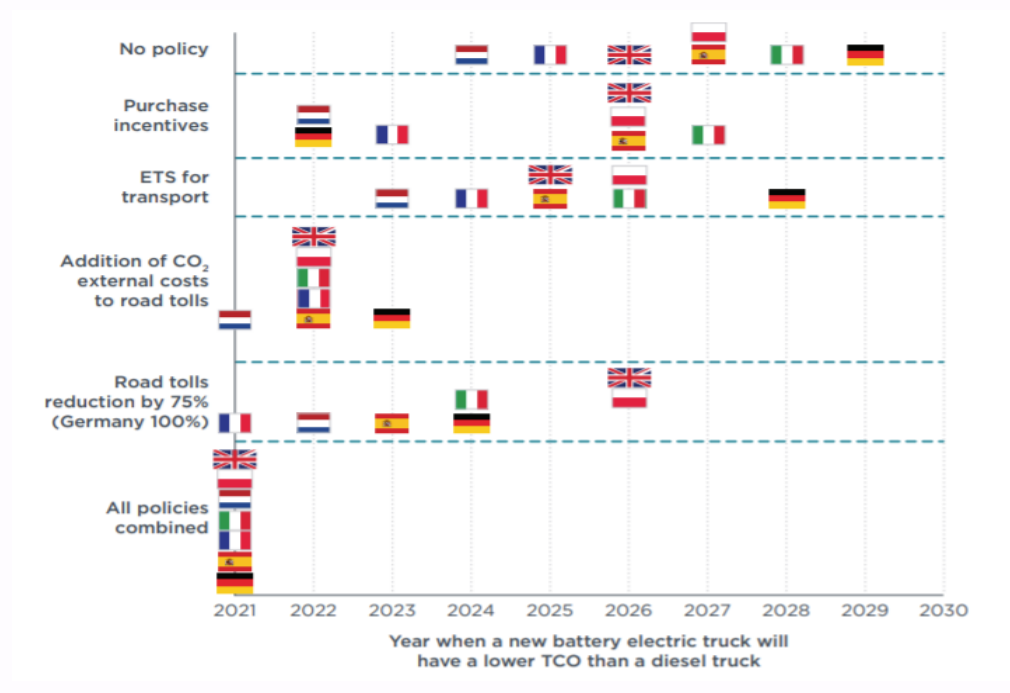

Government Incentives and Regulations

The transition to electric trucks is being actively supported by both EU-level initiatives and individual Member State incentives. These measures are crucial in bridging the current cost gap between electric and traditional diesel trucks.

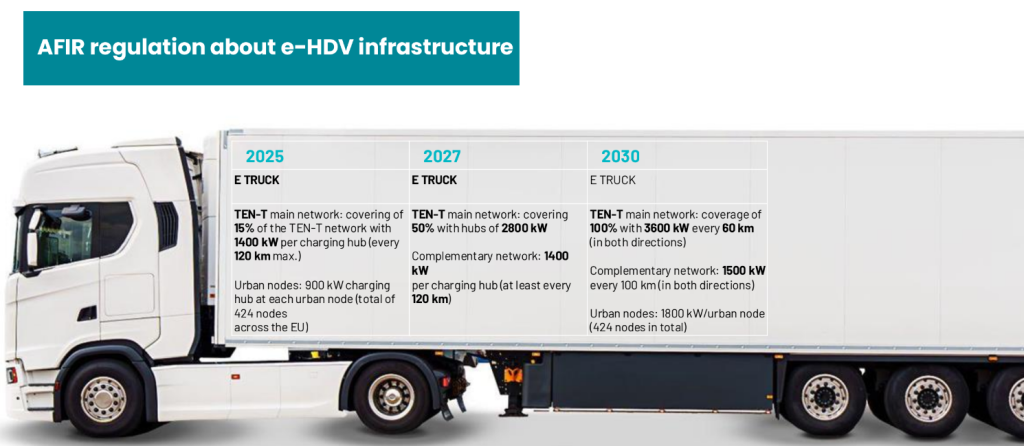

At the EU level, mandates are pushing for carbon neutrality by 2050, with all new vehicles, including heavy-duty trucks, required to be zero-emission by 2040. Regulatory pressure from initiatives like AFIR is a significant driver for the industry's transformation.

Individual EU member states offer a variety of incentives:

- Purchase Subsidies: Direct financial support for the acquisition of electric trucks, helping to offset the higher initial costs.

- Charging Infrastructure Support: Grants and funding for the installation of charging stations, both at the national and EU level.

- Road Tax Discounts: Many countries offer reduced or waived road taxes for electric vehicles.

- Special Privileges: Some areas provide access to special lanes or zones for pure electric vehicles.

The ECG Association notes that these incentives significantly impact the Total Cost of Ownership (TCO) calculations. In markets with strong regulatory pressure, cost parity for electric trucks is reached earlier. For instance, discounts on road tax, higher annual vehicle tax based on emissions, and exemptions for electric trucks all contribute to improving their economic viability.

Challenges and Considerations

The trajectory for electric trucks appears promising, yet several significant hurdles remain on the road to widespread adoption. Infrastructure development stands as a primary concern, particularly for long-haul routes where extensive charging networks are essential. This challenge is closely tied to the need for continued technological advancements.

As battery technology and charging speeds improve, the viability of electric trucks across all applications will increase. However, current range limitations still pose challenges for very long-haul routes, potentially necessitating alternative solutions in the near term.

Attention must also be paid to grid capacity. Ensuring sufficient power supply and integrating renewable energy sources will be crucial to support the increasing demand.

The transition also raises questions about the long-term residual value of these vehicles. While current market conditions suggest higher residual values for electric trucks due to lower depreciation costs, the long-term trends remain uncertain and will likely depend on factors such as technological progress, policy support, and market acceptance.

Conclusion

The comparison between electric and traditional trucks in Europe reveals a clear trend towards electrification. While electric trucks currently face higher upfront costs, their lower operational expenses, combined with government incentives and regulatory pressure, are rapidly improving their economic competitiveness.

The ICCT study projects that battery electric trucks will be the least expensive option for most truck classes before 2030, with hydrogen fuel-cell trucks following suit by 2035. Traditional trucks running on alternative fuels like HVO, e-diesel, and bio-CNG are expected to struggle economically in comparison.

As Europe pushes towards its 2050 carbon neutrality goal, the trucking industry stands at the cusp of a major transformation. Major logistics companies, retailers, and manufacturers have begun integrating electric trucks into their fleets, supported by a growing network of high-power charging stations that enable reliable long-distance operations.

Ekoenergetyka is leading this transition with our cutting-edge SAT1500 MCS charging solution. Unveiled at IAA Transportation 2024, the SAT1500 MCS can deliver up to 1440 kW of power through one of its two outputs.

All in all, the combination of technological advancements, policy support, and market demands is creating a favorable environment for the widespread adoption of electric trucks.